Southland Home Sales Edge Higher; Price Growth Slows

October 2014

Irvine, CA—Southern California home sales hit a five-year high for a September, rising slightly above a year earlier for the first time in 12 months amid gains for mid- to high-end deals. The median sale price fell below an 80-month high reached in August and for the first time in more than two years none of the Southland counties posted a double-digit year-over-year price gain, CoreLogic DataQuick reported. A total of 19,348 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month.

Irvine, CA—Southern California home sales hit a five-year high for a September, rising slightly above a year earlier for the first time in 12 months amid gains for mid- to high-end deals. The median sale price fell below an 80-month high reached in August and for the first time in more than two years none of the Southland counties posted a double-digit year-over-year price gain, CoreLogic DataQuick reported. A total of 19,348 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month.

That was up 2.9 percent from 18,796 sales in August, and up 1.2 percent from 19,112 sales in September 2013, according to CoreLogic DataQuick data. On average, sales have fallen 9.4 percent between August and September since 1988, when CoreLogic DataQuick statistics begin. Last month marked the first time sales have risen on a year-over-year basis since September last year, when sales rose 7.0 percent from September 2012. September home sales have ranged from a low of 12,455 in 2007 to a high of 37,771 in 2003. Last month’s sales were 18.3 percent below the September average of 23,695 sales. The median price paid for all new and resale houses and condos sold in the six-county region last month was $413,000, down 1.7 percent from $420,000 in August and up 8.1 percent from $382,000 in September 2013. The August 2014 median was the highest for any month since December 2007, when it was $425,000. The median’s 8.1 percent year-over-year gain in September marked the fourth consecutive month with a single-digit annual increase following 22 straight months of double-digit gains of as much as 28.3 percent.

“Price appreciation has dipped into single-digit territory as more would-be buyers get priced out, investors back off and incomes rise modestly at best. Yet there are still upward forces on home prices: Jobs are being created and families started at a time when the supply of existing homes for sale, as well as the number of new homes being built, remains relatively low. The good news for those looking to buy a home now is that mortgage rates remain very low in an historical context, and we’re past the peak home-buying season. Today’s home shoppers are more likely to find a less-crowded market with fewer intense multiple-offer situations and more serious, realistic sellers,” said Andrew LePage, an analyst with Irvine-based CoreLogic DataQuick.

Last month was the first since June 2012 in which none of the six Southland counties posted a double-digit, year-over-year gain in its median sale price (all had single-digit increases). Orange County’s $585,000 September median was the closest – within 9.3 percent – to its all-time peak of $645,000 in June 2007. For the Southland overall the September median stood 18.2 percent below the peak $505,000 median in spring/summer 2007. Home prices have been rising at different rates depending on price segment. In September, the lowest-cost third of the region’s housing stock saw a 10.9 percent year-over-year increase in the median price paid per square foot for resale houses. The annual gain was 6.6 percent for the middle third of the market and 4.5 percent for the top, most-expensive third. The number of homes that sold for $500,000 or more last month rose 9.0 percent compared with a year earlier. But sales below $500,000 fell 6.7 percent year-over-year. Sales below $200,000 dropped 24.7 percent. Sales in the lower price ranges are hampered by, among other things, the drop in affordability over the last year, a fussy mortgage market and a relatively low inventory of homes for sale.

In September, 36.7 percent of all Southland home sales were for $500,000 or more, down from 38.5 percent in August – an 81-month high – and up from 33.2 percent in September 2013. Distressed property sales continued to play a lesser role in the market. Foreclosure resales – homes foreclosed on in the prior 12 months – represented 4.7 percent of the Southland resale market last month. That was down from a revised 5.0 percent the prior month and down from 6.4 percent a year earlier. In recent months the foreclosure resale rate has been the lowest since early 2007. In the current cycle, foreclosure resales hit a high of 56.7 percent in February 2009. Short sales – transactions where the sale price fell short of what was owed on the property – made up an estimated 6.0 percent of Southland resales last month. That was up insignificantly from 5.9 percent the prior month and down from 10.9 percent a year earlier. Absentee buyers – mostly investors and some second-home purchasers – bought 23.3 percent of the Southland homes sold last month. That was the lowest absentee share since October 2010, when 22.1 percent of homes sold to absentee buyers. Last month’s figure was down from 23.8 percent the prior month and down from 27.0 percent a year earlier. The peak was 32.4 percent in January 2013, while the monthly average since 2000, when the CoreLogic DataQuick absentee data begin, is about 19 percent.

Buyers paying cash accounted for 24.3 percent of September home sales, down from a revised 24.5 percent in August and down from 28.7 percent in September last year. Last month’s figure was the lowest since June 2010, when 24.2 percent of Southland homes were bought with cash. The peak was 36.9 percent in February 2013, and since 1988 the monthly average is 16.7 percent.

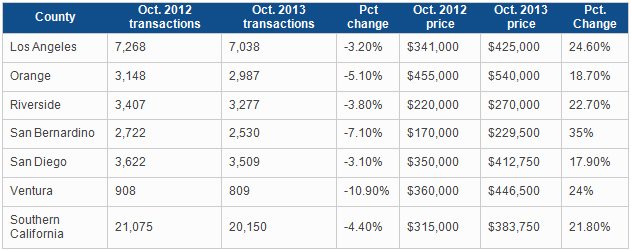

| Sales Volume | Median Price | |||||

| All homes | Sep-13 | Sep-14 | %Chng | Sep-13 | Sep-14 | %Chng |

| Los Angeles | 6,496 | 6,717 | 3.40% | $425,000 | $455,500 | 7.20% |

| Orange | 2,916 | 2,980 | 2.20% | $550,000 | $585,000 | 6.40% |

| Riverside | 3,141 | 3,115 | -0.80% | $269,000 | $295,000 | 9.70% |

| San Bernardino | 2,358 | 2,401 | 1.80% | $225,000 | $238,000 | 5.80% |

| San Diego | 3,383 | 3,322 | -1.80% | $422,000 | $445,000 | 5.50% |

| Ventura | 818 | 813 | -0.60% | $445,000 | $460,000 | 3.40% |

| SoCal | 19,112 | 19,348 | 1.20% | $382,000 | $413,000 | 8.10% |

Source: DQNews.com

Copyright 2014 DataQuick. All rights reserved.